As my long time readers know, I have a fixation with the global move toward a cashless society, something that has fascinated me for decades although the technology needed for such a seismic shift in the economy has really only existed for roughly a decade. A recent publication on what are now being termed central bank digital currencies or CBDCs by the Bank for International Settlements, the central bank for central banks given that it is owned by 63 central banks which account for 95 percent of global GDP provides the world with an update on the evolution of the technology which will prove to be a global game-changer.

To put all of the information in this posting into perceptive, we need to start by looking at the BIS definition of central bank digital currencies:

"A CBDC is central bank-issued digital money denominated in the national unit of account, and it represents a liability of the central bank."

There are two types of CBDCs as follows:

1.) Retail CBDCs: Retail CBDCs are intended for use by the general public and are referred to as a “general purpose” CBDC. As such, it offers a new option to the general public for storing value and making payments. A retail CBDC is different from existing forms of cashless payment instruments for consumers and businesses, such as credit transfers, direct debits, card payments and e-money, as it represents a direct claim on a central bank rather than the liability of a private financial institution.

2.) Wholesale CBDCs: Wholesale CBDCs are intended for use by financial institutions. A wholesale CBDC is similar to today’s central bank reserves and settlement accounts in that it is intended for the settlement of large interbank payments or to provide central bank money to settle transactions of digital tokenised financial assets in new infrastructures

Here is the cover page of the report which, tellingly, is entitled "Gaining momentum":

The report outlines the results of a survey of 81 central banks which was conducted in the fall of 2021. The survey asked central banks about their engagement in working toward CBDCs and their motivations and intentions regarding the implementation of CBDCs. It is important to keep these developments in mind:

"After The Bahamas launched a live retail CBDC (the Sand Dollar) in 2020, Nigeria followed in 2021 with the issuance of eNaira, and the Eastern Caribbean and China released pilot versions of their respective DCash and e-CNY."

The central banks of the 81 jurisdictions that relied to the survey represent nearly 76 percent of the world's population and 94 percent of global economic output. Twenty-five of the respondents are classified as advanced economies and 56 are in emerging markets/developing economies.

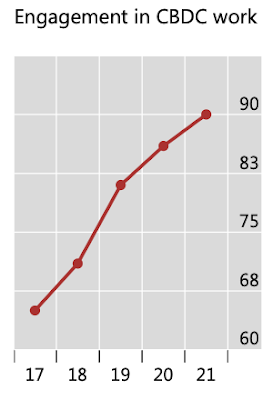

Here is a graph showing the very significant growth in the share of central banks that are actively engaged in some form of CBDC development over the past five years:

Here is a graph showing how the focus of the development by type of CBDCs has evolved over the past five years:

The development of retail CBDCs is significantly more advanced than the development of wholesale CBDCs with almost 20 percent of central banks developing or testing a retail CBDC, twice the share of central banks developing a wholesale CBDC.

Here is a graph showing the focus of the development of CBDCs in 2021:

In 2021, 26 percent of central banks are either currently developing a CBDC or running a pilot project, up from 14 percent in 2020. In addition, 62 percent are conducting either experiments with or proofs-of-concepts of CBDCs.

There are two mechanisms by which central banks can distribute CBDCs to the public as follows:

1.) One-tiered model: Central banks directly distribute CBDCs to the public, providing both the CBDC account and wallet services.

2.) Two-tiered model: Central banks work with trusted private sector intermediaries (i.e. retail banks) to distribute CBDCs to the public. In this case, the private sector would be responsible for onboarding clients and performing know-your-customer and anti-money laundering/combating the financing of terrorism procedures. The private sector would also record retail transactions and handle retail payments.

The report notes that 70 percent of central banks that are involved in some form of CBDC issuance are considering the implementation of a retail CBDC that involves the private sector.

In case you were wondering, there are several motivations for issuing a retail CBDC as follows:

1.) financial stability

2.) monetary policy implementation

3.) improving domestic payments efficiency

4.) improving cross-border payments efficiency

5.) payments safety and robustness

We might also add the following reason for implementing a retail CBDC right from the mouth of BIS General Manager Augsten Carstens:

Here's the punchline:

"The central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability and also we will have the technology to enforce that."

The issuance of a CBDC requires that a nation have in place a legal framework which provides its central bank with the legal authority to do so. On a year-over-year basis, the share of central banks with legal authority increased from 18 percent to 26 percent in 2021 and an additional 10 percent of jurisdictions are in the process of changing their laws to authorize CBDC issuance. This means that in the near future, 36 percent of the world's central banks will soon have the legal authority to issue CBDCs.

To summarize, 68 percent of central banks consider that they are likely to or high possibly issue retail CBDC in the short- or medium-term. The self-reported likelihood is higher among emerging market/developing economy nations than it is for advanced economies. Here is a summary showing how the likelihood of issuing both a retail and wholesale CBCD has increased markedly over the past four years:

If you wish to educate yourself further on CBDCs, here is a video from BIS outlining the "uncharted waters of retail CBDCs":

Let's close with a few thoughts. As I have stated in the past and given Augsten Carstens' comments and Chrystia Freeland, Canada's Deputy Prime Minister, recent moves to freeze the bank accounts of those that it deemed "wrong thinkers" as shown here:

...do you really think that retail CBDCs will work to the greater benefit of society as a whole? Or, will it just give more power to the ruling class who will be able to record and control our every expenditure, particularly if a programable CBDC ecosystem is implemented?

CBDCs - gaining momentum indeed.