The globe is entering a new food reality. There are shortages (and looming shortages) of many food items and certain food items, particularly meat, are falling under the critical eyes of the ruling class who are doing their utmost to wean us from our "meat habit" under the guise of protecting the global environment. In this posting, we will look at one study that attempts to explain a mechanism for reducing meat consumption, thereby protecting Mother Earth.

A report entitled "Is Meat Too Cheap? Towards Optimal Meat Taxation" by Franziska Funke et al at the Institute for New Economic Thinking at the Oxford Martin School at the University of Oxford:

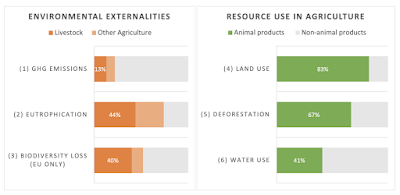

...opens by noting that livestock plays a significant role global environmental issues and negatively impacts issues around climate change, global nitrogen and phosphorus cycles, water and land use and biodiversity, issues that need to be solved since the global trajectory of meat production and consumption is unsustainable. A failure to mitigate the greenhouse gas emissions from the meat industry in particular (and agriculture as a whole) could preclude meeting the 1.5 degree Celsius climate change objective. The authors note that, as it stands currently, the retail price of meat does not reflect the negative ecological impact of the industry given that livestock farming is responsible for roughly 13 percent of global greenhouse gas emissions. Here is a graphic showing the impact of the meat industry on the environment:

Here is a quote from the paper:

"...the requirements of a net-zero carbon transition, and calls for ‘building back better’ after the Covid-19 pandemic, have raised not only the need, but also the prospects of more stringent regulation of meat in developed countries. From the perspective of environmental economics, it is clear that appropriate pricing of meat, which reflects its social costs, should be at the core of such regulation."

The authors note the following three key environmental externalities from meat production:

1.) emission of methane (from enteric fermentation in ruminants and manure storage), nitrous oxide (from fertilizer application and manure processing) and carbon dioxide from feed-related direct land- use changes and energy use

2.) nutrient pollution in the form of ammonia (NH3), nitrogen oxides (NOx), nitrates (NO3−) and organic N, results in soil acidification, eutrophication of oceans and freshwater pollution. Through ammonia emissions and particulate matter from animal manure, livestock is also a significant contributor to local air pollution, causing respiratory health issues in agricultural workers, local residents and the general population.

3.) biodiversity loss from livestock farming is largely driven by land use change. The associated social costs of decreasing biodiversity will be much higher once the total economic damage from destroyed ecosystems is included, for example the loss of regulating, supporting and cultural ecosystem services.

To date, governments have been unwilling to use fiscal policies to address the costs of meat production and with good reason given the potential negative political implications of yet another tax, particularly while food prices and food price inflation remain at elevated levels. Nonetheless, the authors suggest that livestock farming and meat consumption should be...

"...subject to targeted externality-correcting instruments: optimal carbon pricing, nitrogen regulation and ecosystem valuation. In the absence of these options, however, meat taxes can be an attractive second-best instrument to make progress on many regulatory objectives at once, for which livestock production and meat consumption are of primary importance."

Here is a table showing the potential components of a tax on meat above and beyond the current VAT (in the EU):

Here is an additional quote:

"As a simple example, take two prominent environmental externalities of livestock farming, greenhouse gas emissions and nutrient pollution: A fully externality-correcting tax on GHG emissions from livestock will likely have the co-benefit of reducing local nutrient pollution."

Of course, given that we now live in the era of the "plant-based diet, the authors note that consumers will shift to meat substitutes as meat consumption decreases with my bolds:

"A reduction in the consumption of meat is likely to be accompanied by a shift to meat substitutes, which in general have a lower environmental impact, especially when they are plant-based. There is a large variety of such substitutes, ranging from unprocessed foods such as beans or lentils, to more processed plant-based products (meat analogues) such as tofu and Quorn, to novel prroducts such as lab-based, or ‘cultured’ meat. However, for the most novel products information about upscaling is not yet available. Over the past decade, continued innovation has allowed for the commercialization of a larger variety of meat analogues, many with a close semblance to meat, such as the ‘Beyond’ and ‘Impossible’ burgers. The first proof of concept of cultured meat was showcased in 2013: a burger reputed to have cost over $250K. Costs have already decreased substantially but much uncertainty remains around the costs of mass production.

By further encouraging the uptake of meat substitutes, the introduction of a meat tax, as an indirect alternative to higher R&D subsidies, could accelerate the development and commercialization of cultured meat and meat analogues. This indirect effect of meat taxes on innovation might be a justification for higher present-day taxes on meat consumption....

Meat taxes can encourage the uptake of alternative protein products by decreasing their relative price and thereby making them more competitive with conventional meat products. The success of meat alternatives, however, will to a large extent depend on the degree of substitutability between meat and alternative protein products, with those that are cheap and have the taste and “mouth-feel” of meat more likely to gain the largest market share."

Setting the stage for eating insects, weeds and 3D printed "meat", are we?

While the authors observe that meat taxes could be met with strong public opposition, they offer the following solution to that issue:

"Nevertheless, the design of actual meat taxation policies can be modified to increase public support. Work on public support for carbon pricing suggests that the framing of the tax proposal and use of revenues are decisive determinants for getting citizens on board. In a study of German, US American and Chinese citizens, Fesenfeld et al. (2020) demonstrate that policy packaging can enhance support of meat taxes. The public support for taxes has been highest when they were at a moderate level and combined with popular policies such as animal welfare standards, discounts on vegetarian meals and information campaigns. More ambitious meat taxes can also be made more appealing by simultaneously lowering agricultural subsidies to meat farmers, introducing more stringent farming standards, and using tax revenue to support low-income households."

Given the unprecedented growth in indebtedness that governments have accrued during the pandemic, they will be desperate for any source of income, particularly as interest rates on their sovereign debt rises. A tax on meat fulfills part of their desire to help the serf class part with their hard-earned money. Fortunately, the demonstrations by farmers in many countries, but most particularly the Netherlands...

...are showing the global oligarchy that their dystopic plans for a carbon-free future which includes those in the livestock industry may not be as widely loved by the masses as they may hope.