With the American banking sector under stresses that have not been seen since 2008 and the response by the Biden Administration to the crisis, it is important to better understand the ability of the Federal Deposit Insurance Corporation (FDIC) to respond to this ongoing crisis.

First, let's look at the total funds on deposit with American commercial banks from Table 2 of the Federal Reserve's H.8 weekly report dated March 17, 2023:

There is currently $17.5947 trillion on deposit at American commercial banks, down from $18.0164 in February 2022. Note that this amount includes all deposits not just those that are covered by the FDIC.

Now, let's go to the 2022 Annual Report for the Federal Deposit Insurance Corporation. Here is a graphic showing the estimated Deposit Insurance Fund's (DIF) insured deposits going back to March 31, 2012:

As of September 30, 2022, there were an estimated $9.9 trillion of FDIC insured deposits in approxamtedly 865 million accounts at 4,755 institutions, keeping in mind that the maximum coverage is $250,000 per depositor per FDIC-insured bank, per ownership category.

Here is a graphic showing the deposit insurance fund (DIF) reserve ratios going back to March 31, 2012 with the aforementioned statutory minima reserve ratio being highlighted with a dashed horizon line:

The current DIF reserve ratio of 1.26 percent is well below the legally mandated 1.35 percent minimum. FDIC's management claimed that "extraordinary growth in insured deposits during the first and second quarters of 2020 caused the DIF reserve ratio to decline below the statutory minimum of 1.35 percent". As such, the FDIC board of directors adopted a "Restoration Plan" to restore the reserve ratio to at least 1.35 percent within eight years as required by the Federal Deposit Insurance Act. Notably, the FDIC's board notes that this will only happen if there are no "extraordinary circumstances". In June 2022, the FDIC projected that the statutory minimum of 1.35 percent would not be reached by September 30, 2029, and, as such, approved an Amended Restoration Plan which increased the initial base deposit insurance assessment rate of 2 basis points.

Here is a table which summarizes the financial situation of the FDIC:

To cover $9.9 trillion worth of protected deposits, the FDIC's insurance fund balance is only $128.218 billion. This is where the problem lies given that there were already $163.809 in insured deposits at 42 "problem institutions".

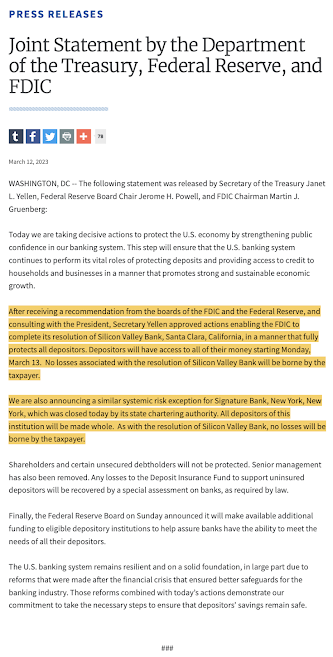

The Federal Deposit Insurance Corporation's deposit insurance scheme is clearly not designed to protect depositors from the collapse of either large banking institutions or a multiple of small banking institutions at one time (as is happening now). In the cases of the Silicon Valley Bank and Signature Bank, depositors were granted coverage for all of their deposits because Treasury Secretary Janet Yellen and two-thirds of the FDIC and Federal Reserve boards agreed that there was a "systemic risk" to the American financial system as quoted here:

...and here:

The only problem is that the implementation of the systemic risk exception creates an imbalance in the banking sector as exemplified in this exchange between Senator Lankford and Janet Yellen at the Senate Committee on Finance Committee Hearing on the President's Fiscal Year 2024 Budget held on March 16, 2023:

Imagine that, the government and the Federal Reserve not being able to see the unintended consequences of their policies. Given her responses, how on earth did Janet Yellen ever become the head of the Federal Reserve let alone the Secretary of the Treasury?

If you wish to watch the entire exchange, please go to the 1 hour and 50 minute mark of the video of the Committee on Finance Hearing at this link.

The banking sector in the United States (and given the global nature of the banking system) is under stresses that have not been seen since the Great Recession. The Federal Deposit Insurance Corporation is not capable of ensuring that depositors are covered and, given the nearly $10 trillion in savings in commercial banks, even Washington will not have the funding to protect the savings of millions of Americans should there be a catastrophic failure of one or two of the major players in the banking system.

No comments:

Post a Comment