The

Brookings Institute recently released its quarterly MetroMonitor for the last quarter of 2011. With headline numbers showing that job gains picking up and the nation's inflation-corrected GDP growing at 3

percent in the final three months of 2011, it is interesting to see how the

economic gains are reflected in the metropolitan data.

Here

is a map showing the nation's 100 largest metropolitan areas divided into

quintiles (five brackets of 20 percent each) with the better performing areas in blue dots and the poorer

performing areas in orange dots:

Notice

that overall economic performance is unevenly distributed across the United

States. The northeastern states seem to be recovering very slowly with

the exception of Worcester, MA. Boston and Hartford are also showing good

economic performance, however, these are the exceptions. Florida is also

suffering from poor overall economic performance with the exception of Cape

Coral. Areas in Florida that were hard-hit by the decimation of their

real estate markets sill remain economically weak. Rather surprisingly,

the economic climate in the industrial heartland has been strengthening with

improvements in automobile sales, resulting in more jobs for auto

workers, including those in Detroit. California still has the highest

proportion of poorly performing metropolitan areas with five of the nations

twenty weakest metropolitan economies being found in California.

While

the economies of the largest metropolitan areas showed some improvement, some

of the gain was in output rather than employment. Of the 100 metropolitan

areas, twenty-seven gained output but lost jobs, particularly in the Great

Lakes manufacturing belt, the Intermountain West and Texas. Between the

third and fourth quarter of 2011, the rate of output accelerated in sixty-seven

metropolitan areas while job growth accelerated in only fifty-two. Slowing

job growth was noted in thirty-four centers including those that specialize in

high technology, the Great Lakes manufacturing belt and five of the six large

metropolitan areas in Texas. This does not particularly bode well for the future.

Let's

look at the employment picture in more detail. In all of 2011, only twenty-four

metropolitan areas gained jobs in every quarter. Seventy-six of the one

hundred areas lost a greater share of jobs after the start of the Great

Contraction in the last quarter of 2007 than they did during the first 16

quarters of the three previous recessions. Four years after the start of

the Great Recession, the 100 largest metropolitan areas, in combination, had

still lost 5 percent of the jobs that they had at the start of the Great

Recession. By way of comparison, in the four years after the start of the

1981 - 1982 recession, employment had risen by 8 percent, four years after the

start of the 1990 - 1991 recession, employment had grown by 2 percent and after

the 2001 recession, employment had grown by 0.02 percent in the same time frame.

This shows us how intransigent America's unemployment issue is this time.

By

the fourth quarter of 2011, employment had rebounded from its low point in 94

of the 100 metropolitan areas but only 25 had gained back more than half of the

jobs that they lost between their pre-Great Recession employment peak and their

post-Great Recession nadir and only five of the 100 had completely recovered

all of their job losses. Metropolitan areas in Texas and those that are

centres of either government or high tech industry recovered larger portions of

their lost jobs.

What's

interesting to see in this time of massive government debt is rising government

employment levels. In the third quarter of 2011, federal government

employment rose in 83 of the 100 metropolitan areas. State government

employment rose in 60 areas. In contrast, local government job cuts

continue with local government employment falling in 55 metropolitan areas

indicating that local government jobs cuts are still ongoing as municipalities

are forced to cut expenses to balance their budgets.

Overall

unemployment in December 2011 was lower on a year-over-year basis in 93 of the

100 largest metropolitan areas with only Chicago, Augusta, Honolulu, Jackson,

New York and Raleigh having higher unemployment in December 2011 than they did

in December 2010. That said, all of the 100 largest metropolitan areas

had higher unemployment rates in December 2011 than they did at the beginning

of the Great Recession in December 2007. That's some recovery!

Here's a listing of the metropolitan areas in the United States that have

unemployment rates in excess of 10.5 percent, over 2 percentage points higher

than the national average:

In

February 2012, out of the 372 metropolitan areas that the Bureau of Labor

Statistics samples, 61or 16.4 percent have U3 unemployment rates in excess of

10.5 percent. These include large urban centers like Los Angeles

(11.0 percent), Detroit (10.8 percent) and Las Vegas (13.1 percent). It

is surprising to see that unemployment in February 2012 was actually worse in

all three of these centers compared to just two months earlier.

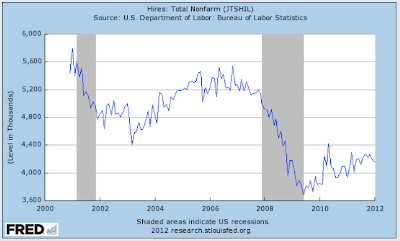

Perhaps

this chart from the St. Louis Federal Reserve

FRED database will help explain the current employment situation in America:

It

is quite apparent that, while the total number of hirings is off its lows of

2009, it has not recovered to anything resembling the period before the Great

Recession. In the months before the Great Recession began, employers were

hiring between 5 adn 5.5 million workers. This dropped to a low of 3.7

million in June 2009 and has since recovered to between 4.0 and 4.2 million

hires per month. This is a recovery of only 13.5 percent from the depths

of the Great Recession and is roughly 21 percent below the hiring level noted

during "normal" periods of economic growth.

All

of that said, we can at least be thankful that we aren't young workers under

the age of 25 in Spain who are facing this (see line ES):

While the headline numbers show that the unemployment

situation in the United States is improving, the data from FRED, the Bureau of

Labor Statistics and the Brookings Institute show that the "recovery"

is uneven at best and that some areas of the United States have barely

experienced what could be termed an economic turnaround in any sense of the

word.

No comments:

Post a Comment