The global central bankster cabal is making very clear moves toward a central bank digital currency (CBDC) ecosystem and it appears that most governments are going along with the game since it will be part of their plan to control all of society and will form a key part of the looming social credit score system. Fortunately, at least a handful of members of the United States Congress have seen the dangers of a future where unelected central bankers are "in charge of the henhouse".

As background, here is a map from the Atlantic Council's Central Bank Digital Currency Tracker website showing the near universality of the experimentation with and implementation of CBDCs:

Several of the world's largest economies have either launched a pilot program (China, Russia and India among others) or are in the development stage of a CBDC program (the United States, the United Kingdom, Canada, Brazil and most of Europe among others).

In the case of the United States, here is the timeline for a CBDC which will be used for both wholesale and retail applications:

"Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell have reaffirmed the United States' interest in a digital dollar. At the NYTimes Dealbook Conference, in response to our tracker, Secretary Yellen said: “I think it [the digital dollar] could result in faster, safer, and cheaper payments, which I think are important goals." During a testimony before the Senate Banking Committee, Powell began by confirming, “We are looking carefully, very carefully at the question of whether we should issue a digital dollar."

Individual Federal Reserve banks are also partnering with various stakeholders on their research. The New York Fed is working with the Bank of International Settlements to identify critical trends and financial technology relevant to central banks. The Federal Reserve Bank of Boston is collaborating with the Massachusetts Institute of Technology's Digital Currency Initiative on "Project Hamilton." The findings of the first phase of Project Hamilton indicated that the processor could bring 99% of transactions to completion in under five seconds, and could settle between 170,000 and 1.7 million transactions per second. In addition to the government-led developments, there are also several private sector projects exploring different models of a digital dollar.

In March 2022, the Biden administration signed an Executive Order on ensuring responsible innovation in digital assets. The EO calls for reinforcing American leadership in the financial system, maintaining the stability of the financial system and exploring a possible CBDC. The order encourages research efforts of the Fed, calls for US involvement in cross-border, multi-lateral testing and promotes standard-setting efforts by US. In May 2022, Vice Chair of the Federal Reserve Board of Governors, Lael Brainard, testified to Congress regarding the Fed's authority to issue a CBDC. She also expressed concerns that given developments in Europe, the US might fall behind on the technological advantages of CBDCs. In September 2022, seven reports were released which dove into the issues of consumer and investor protection, illicit finance and environmental risk mitigation, design principles for a US CBDC and US leadership in digital asset technology. In November 2022, The Federal Reserve of New York announced Project Cedar, which tested wholesale application of a CBDC."

The Federal Reserve/Biden Administration will not see the United States left behind when it comes to development and implementation of CBDC technology as they claim that this new payment system could jeopardize the nation's security and geopolitical objectives if another nation were to control this new ecosystem.

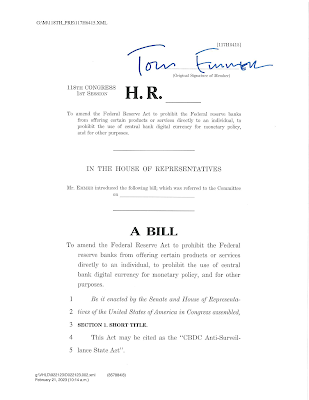

That said, as I noted at the beginning of this posting, a handful of congressional members believe that the implementation of CBDC's will strip Americans of their right to financial privacy. Here is the announcement from House Majority Whip Tom Emmer who introduced the CBDC Anti-Surveillance State Act:

The objective of the bill is to ensure that the Federal Reserve does not have the ability to issue a CBDC directly to an individual which would give it an instrument to collect personal information on all Americans as the retail bank sector does now. The bill also bars the Federal reserve from using CBDCs to implement monetary policy (i.e. control the economy). In addition, the findings of any studies and pilot programs on the use of CBDCs must be reported each quarter to Congress.

Here is the text of the bill:

This is not Congressman Ted Emmer's first "kick at the CBDC can". Back in January 2022, he introduced a bill that would prohibit the Federal Reserve from issuing a CBDC directly to individuals through the utilization of a Federal Reserve retail bank account, noting that "...requiring users to open an account at the Fed to access a CBDC would put the Fed on an insidious path akin to China's digital authoritarianism." I personally find that logic difficult to argue with.

Here is the text of that bill:

While I don't generally trust the motivations of politicians, it is interesting to note that at least some members of the United States Congress are "woke" when it comes to the issuance of CBDCs and the accompanying abuse of what little remains of our privacy, something that seems to have evaded the vast majority of the world's political class. Either that or they simply don't care.

No comments:

Post a Comment