With the Federal Reserve announcing its FedNow instant payments service which is essentially the "plumbing" for a central bank digital currency ecosystem which will launch in July 2023 and that expansion of the service is planned for the future:

...a recent survey by the Cato Institute is particularly timely.

While some people feel that we are already living in a digital dollar reality brought to us by our use of credit and debit cards and other digital payment platforms like PayPal, Apple Pay, Google Play, Zelle etcetera, in fact, there is a big difference between the current platforms and what is being proposed by the Federal Reserve and other central banks around the world. The digital dollars of today are a liability of the private commercial bank sector. In contrast, a central bank digital currency is a liability of a central bank, meaning that there is a direct connection between a nation's central bank and the citizens of a nation. Rather than a government having to request payment information from a commercial bank through various legal procedures, the government could technically get your personal spending information directly from a central bank without requiring legal permission from a court.

In its 2023 CBDC National Survey, the Cato Institute examines how Americans feel about the implementation of a central bank digital currency by the Federal Reserve. Let's go through some of the questions and responses.

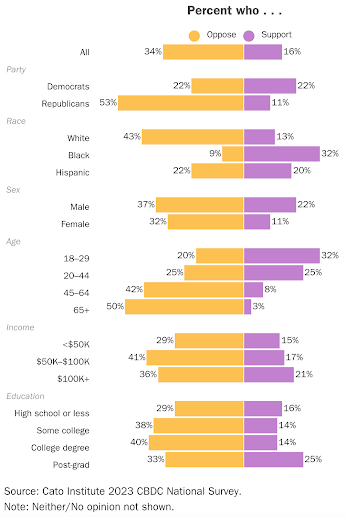

Here is the first question. There are proposals for the Federal Reserve to begin offering a government-issued digital currency, called a “central bank digital currency” (CBDC). Would you support or oppose the proposal?

While only 16 percent of Americans support a CBDC as shown here:

...the support varies significantly by party affiliation with 22 percent of Democrats supporting the idea compared to only 11 percent of Republicans and 14 percent of independents. A very substantial portion of Americans are not particularly familiar with the concept of a central bank digital currency which is extremely concerning given that the implementation of a CBDC will be a financial game-changer with far-reaching consequences for all of us. Only 36 percent of Republicans are neutral on or not familiar with CBDCs compared to 56 percent of Democrats and 59 percent of Independents.

Here is a graphic breaking down support for a Federal Reserve CBDC by various demographics:

In general Americans who are Black (32 percent), Males (22 percent), Americans under the age of 29 (32 percent), high income (21 percent) and highly educated (25 percent) are supportive of CBDCs.

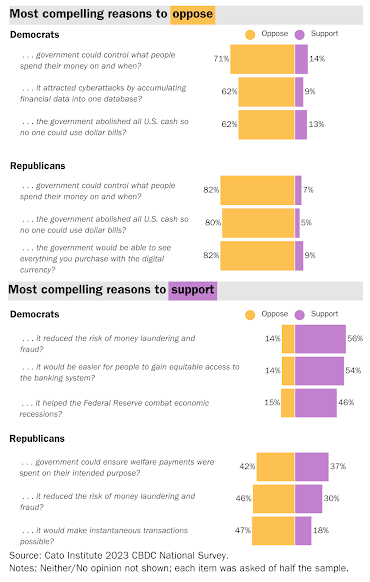

When asked about their concerns about CBDCs, a key concern is the potential lack of privacy or an increase in government control. This is particularly key given the concept that CBDCs could be programmable. Let's break this down further:

1.) 74 percent would oppose CBDCs if it meant that governments could control how people spend their money.

2.) 68 percent would oppose CBDCs if it meant that government could monitor their spending.

3.) 68 percent would oppose CBDCs if it meant that all U.S. cash would be abolished.

4.) 65 percent would oppose CBDCs if it meant that they attracted cyberattacks by accumulating personal financial data into a single large database.

5.) 64 percent would oppose CBDCs if it meant that the government could charge a tax on those who don't spend money during recessions.

6.) 59 percent would oppose CBDCs if it meant that the government could freeze the digital bank accounts of political protestors.

The last issue is one that should be of concern to all of us given the actions of the Canadian government during the Truckers' Protest in February 2022 when the Trudeau government froze the bank accounts of Canadians who donated to the protest as well as those who participated.

Here are some additional so-called benefits regarding CBDCs and how Americans feel about them:

Not surprisingly, a majority of Republicans did not support any of these "benefits", however 37 percent were supportive of government being able to ensure that welfare payments were spent on their intended purpose whereas 55 percent of Democrats were supportive of CBDCs allowing unbanked Americans to have access to a "banking system". Here is a graphic showing the divide along party lines for compelling reasons to oppose and support a CBDC:

To summarize, 76 percent of Americans are more concerned about the potential risks of a CBDC than the potential benefits that they supposedly could offer. Only 24 percent state that "government should issue a central bank digital currency because it would reduce financial crime and other illegal activity and would increase access to the financial system.” By party alignment, 85 percent of Republicans and 68 percent of Democrats believe that government should not allow the issuance of a CDBC.

Since it appears that, in general, Americans are overwhelmingly against the implementation of a Federal Reserve CBDC and since the Federal Reserve is already taking the first steps toward a CBDC ecosystem, one has to wonder how the Fed and the political class in Washington will force feed this to the useless eaters. Will there be a significant fiscal or financial event that will be sold to the peasants as an existential crisis similar to the narrative used to get Americans to line up for vaccines during the COVID-19 pandemic?

No comments:

Post a Comment