In a recent Payments System Research Briefing, the braintrust at the Federal Reserve Bank of Kansas looks at the case of retail central bank digital currencies (CBDCs).

Let's open by looking at the two types of CBDCs:

1.) Retail (or general purpose) CBDCs - these CBDCs will take on the attributes of physical cash and will be used by consumers and businesses. This can be thought of most easily as a "cashless" system.

2.) Wholesale CBDCs - these CBDCs will be used by financial institutions and are intended for the settlement of interbank transfers and could reduce counterparts credit and liquidity risks.

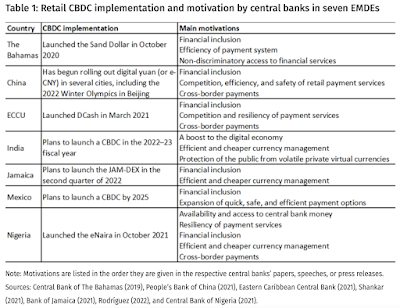

The authors note that, while many central banks are exploring the use of retail CBDCs, only a few have actually taken the steps necessary to implement a retail CBDC as shown on this table:

In the briefing, the authors look at the motivations for issuing retail CBDCs. They note that central banks in emerging and developing economies EMDE) are far more enthusiastic about issuing retail CBDCs compared to their counterparts in advanced economies. Let's look at the motivations for each grouping of nations:

1.) Emerging and Developing Economies (EMDE) - promoting financial inclusion, enhancing payment system efficiency, competition, competition, security and/or resiliency, improving cross-border payments.

In these economies, many consumers have little access to financial services and, as such, rely heavily on cash payments in preference to less-developed electronic payment systems. This results in higher operational costs which would be moderated once the dead for physical cash is reduced. Access to the banking system (i.e. inclusion) seems to be all important to central bankers. For example, in these less developed economies, many individuals are unbanked with about 60 percent of adults being unbanked in Mexico and Nigeria and 20 percent of adults being unbanked in China, India, Jamaica and the Bahamas. The Central Bank of The Bahamas has taken the step of issuing a physical CBDC payment card to unbanked individuals that have no access to a smartphone or computer. The authors state that a Retail CBDC may increase competition and result in lower transaction costs for both merchants and consumers.

2.) Advanced Economies - payment access, resiliency and competition.

While no advanced economy has introduced a retail CBDC, this may reflect the limited potential to improve national payment systems. Interestingly (and I might add ironically), Sweden's central bank claims that the priority policy goal of the "e-krona" is to ensure broad access to payments for those that will be adversely impacted by the move to a cashless society. Central banks in Canada, Japan and Norway have stated that there is currently little motivation to move to a retail CBDC ecosystem, however, should the use of cash decline to the point where it can no longer be used in a wide range of translations or should a private cryptocurrency make significant inroads, these central banks could change their views and move toward a retail CBDC. This is quite interesting given that over half of retailers in Sweden expect to stop accepting cash for payments by 2025 and the use of banknotes in the United Kingdom has fallen from 60 percent of payments by volume in 2008 to 28 percent 2018 and is expected to fall to just 9 percent of payments by 2028 so it looks like central bankers concerns about a decline in the use of cash has already provided them with the reason that they need to foist CBDCs on the globe's advanced economies.

In closing, here is the conclusion to the briefing with my bold:

"Several EMDEs have implemented CBDCs primarily to promote financial inclusion and improve their payments systems. Several advanced economies have made significant progress in assessing the case for a retail CBDC; though a few have identified motivations for implementing a CBDC, most have not found a compelling case to do so.

Many other central banks are still at an early stage in exploring motivations for a retail CBDC, including the Federal Reserve, which recently published a report aiming to foster a public discussion with CBDC stakeholders on the potential benefits and risks of CBDCs (Board of Governors of the Federal Reserve System 2022). Through research and public dialogue, these central banks may increasingly identify motivations for a retail CBDC or scenarios in which a retail CBDC may be warranted. The motivations and scenarios will likely vary across countries, as each country has a unique set of opportunities and challenges in its economy and payment system."

Let's close with this graphic showing the "race for the future of money:":

...and these graphics showing the rapid change in CBDC research and development since April 2021:

Given the changes in the global economy over the past few years, the advanced in blockchain technology, the moves toward a digital identity and the widespread growth of the surveillance state, in my opinion, the imposition of a central bank digital currency ecosystem is a given and that, with the majority of the world's central banks exploring the use of CBDCs, this is likely to be our "new normal" within the next five years.

For a little more information as to the Bank for International Settlements motives, check out Agustin Carsten's comments. Link - https://www.youtube.com/watch?v=rpNnTuK5JJU

ReplyDelete