Recent developments announced by China National Space Administration show how determined China is to maintain its control over a very significant portion of the world's rare earth minerals.

Before we look at the recent announcement, let's look at exactly what rare earth elements are and why they are so critical to the global economy. Rare earth elements or REE are a set of seventeen lanthanides on the periodic table plus scandium and lithium and form part of the critical mineral commodities (non-fuel-based) that form a key part of technology in the 21st century. Here is a periodic table with the rare earth elements highlighted:

Most high technology equipment requires small amounts of rare earths, however, they are critical to the performance of this equipment. The United States Geological Survey (USGS) states the following about rare earth elements:

"Rare-earth elements (REE) are necessary components of more than 200 products across a wide range of applications, especially high-tech consumer products, such as cellular telephones, computer hard drives, electric and hybrid vehicles, and flat-screen monitors and televisions. Significant defense applications include electronic displays, guidance systems, lasers, and radar and sonar systems. Although the amount of REE used in a product may not be a significant part of that product by weight, value, or volume, the REE can be necessary for the device to function. For example, magnets made of REE often represent only a small fraction of the total weight, but without them, the spindle motors and voice coils of desktops and laptops would not be possible."

Here is a video from the USGS outlining the global supply of critical minerals of which rare earth elements comprise an important component:

In particular, critical minerals are essential to the economic and national security of the world's advanced economies; should supply chains for these minerals be interrupted, the lack of supply would have a significant negative impact on both national economies and global economy as a whole.

In early November 2021, the USGS recently announced that it is seeking public comments on critical minerals as part of its obligations under the Energy Act of 2020 as shown here:

Here is a list of the minerals that are considered critical minerals by the U.S. government:

Now, let's look at which nations control the supply of rare earth minerals. Until China emerged as a producer of REEs in the mid-1990s, the United States was the world's largest supplier and during the 2000s, was virtually the world's sole supplier of REEs as shown on this graphic:

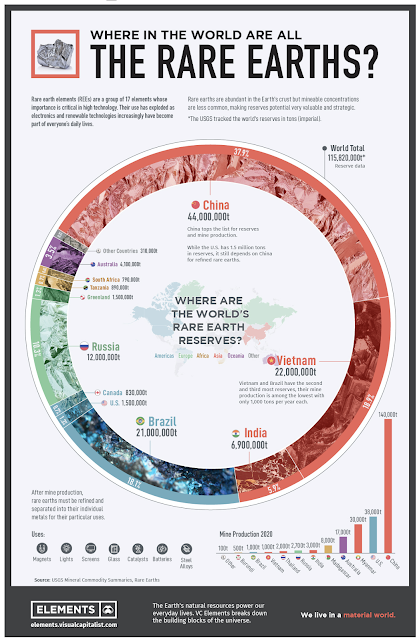

Here is an interesting graphic from Visual Capitalist showing where the REEs are located:

Lastly, here is a table showing how rare earth elements are used:

...and a table showing how the global reserves and production of REE's are distributed (2020 data):

As you can see, at only 1.3 percent of the total, the United States controls a negligible share of the global reserves of rare earth elements.

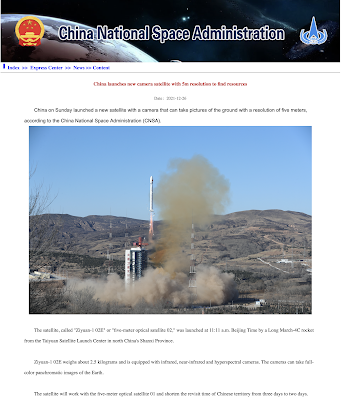

With this background, let's look at the recent announcement from China National Space Administration (CNSA):

CSNA states the following about the uses for its latest satellite witht my bold:

"Pictures taken by the satellite duo will help engineers survey China's geological environment and search for minerals. People working in other areas like transportation, agriculture and disaster mitigation will also receive help from the pictures."

The use of China's newest satellite as a prospecting tool for its mineral resources will likely further cement its status as the world's largest producer and owner of rare earth elements.

While the United States is ramping up its production of rare earth elements, its reserves fall far short of impressive and leave Washington highly vulnerable to supply interruptions. In addition, the recent merger of three rare earth element producers in China as shown here:

... could affect global supplies of REEs and, ultimately have a long term impact on prices which are already inflated as shown here (bid/ask prices in USD in the third and fourth data positions on each screen capture):

This merger will result in the world's second-largest REE producer after China Northern Rare Earth Group and will create a juggernaut that accounts for about 70 percent of China's total heavy rare earths' production.

The United States and the rest of the world's advanced economies are highly vulnerable to China's control of a very significant share of the global supply of rare earth elements. As China seeks to ramp up its already significant reserves of REEs and as technological advances require additional supplies of these elements, particularly as the world moves to a so-called "green future", it is clear that the United States and the rest of the world's advanced economies are highly vulnerable to China's control of a very significant share of the global supply of rare earth elements.

No comments:

Post a Comment