As my long-term readers know, I have a fixation with digital currencies (aka central bank digital currencies) and the impending cashless society. The European Central Bank (ECB) is taking additional steps toward implementing a digital euro through its work with all of the national central banks of Europe.

Here's how the ECB describes the digital euro:

"We are working with the national central banks of the euro area to look into the possible issuance of a digital euro. It would be a central bank digital currency, an electronic equivalent to cash. And it would complement banknotes and coins, giving people an additional choice about how to pay."

Here are its key features:

The digital euro would be stored in an electronic wallet that was set up with a person's bank or other public intermediary such as a post office. People will be able to deposit money into the digital wallet through a linked bank account or by depositing cash (until cash no longer exists). Withdrawals from the wallet would be in the form of digital euros.

In this recent contribution from ECB Executive Board Member Piero Cipollone as found on the ECB's website:

....we find the following quote:

"Being a key player in digital payments and digital finance should be a priority for Europe."

As Mario Draghi pointed out in his recent report, the productivity gap between the United States and the European Union is mostly explained by technology and finance. If we take the information and communications technology (ICT) and financial sectors out, the gap disappears.

If we want to close the productivity gap with the United States, we need to focus on these areas. Digital payments and digital finance stand at the intersection of these two sectors. And they are developing fast, driven by changes in habits and technology. This is both an opportunity and a risk for Europe. It is an opportunity to close the gap by developing innovative and competitive European solutions. But if we do not seize that opportunity, we run the risk of weakening our competitiveness, resilience and strategic autonomy....

We must move swiftly to counter the risks stemming from Europe’s current inability to secure the integration and autonomy of its retail payment system. This is one of the key reasons behind the digital euro project: to bring central bank money into the digital age. Doing so would provide firms and households with a digital equivalent to banknotes and would strengthen our monetary sovereignty....

Complementing banknotes, the digital euro would give all European citizens and firms the freedom to make and receive digital payments seamlessly.

The digital euro would provide a single, easy, secure and universally accepted public solution for digital payments in stores, online and from person to person. It would be available both online and offline, and would be free for basic use.

For merchants, the digital euro would provide seamless access to all European consumers. Moreover, it would offer an alternative that would increase competition, thereby lowering transaction costs in a more direct way than is possible through regulations and competition authorities."

Of course, the ECB is terribly concerned about privacy when it comes to its CBDC:

"Guaranteeing the privacy of digital euro users is an essential part of the project, and the proposed Regulation reflects this with strict provisions on data protection and privacy for both online and offline transactions. The offline functionality would offer users a cash-like level of privacy, both for person-to-person payments and payments in physical shops. The Eurosystem has indicated its readiness to explore the possibility of making a few improvements to the user experience of the digital euro, so that citizens with a stronger privacy preference can benefit from cash-like privacy for all their digital euro payments made in physical proximity. One possible improvement could be to give users the option (i) to make all their low value payments carried out in the proximity of the payee’s device offline payments by default and (ii) to decide on the amount they wish to regularly hold offline and benefit from automated funding, so they do not worry about their offline balance. In order to ensure that this improvement is convenient for users, the offline functionality should be available on mobile devices."

According to the ECB, the digital euro is still in the preparation stage and the bank has called for applications, seeking potential providers of digital euro components and related services. New user research and experimentation activities are now underway to gain insight into users' preferences and to inform decision-making for the digital euro; these include online surveys and interviews which will focus on special target groups such as small merchants and vulnerable consumers. The findings of this phase will be published in mid-2025. Following a call launched in November, the ECB will join with key stakeholders, including merchants, payment service providers, fintech companies and universities, to form innovation partnerships to test conditional payments (i.e. payments that are made automatically when predefined conditions are met) and explore other innovative use cases for a digital euro. An outcome report is expected to be published in July 2025.

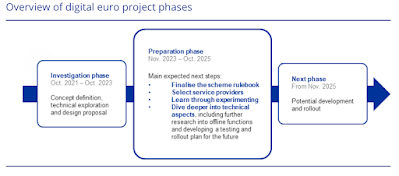

With the call for applications for providers of the components of a digital euro now underway, it's starting to look like a digital euro is more-or-less a given. In fact, if you look at this graphic, you'll notice that the ECB's Governing Council will make a decision for the potential launch of the next phase of the digital euro project in October 2025:

In May 2024, eIDAS 2.0 (the European Digital Identity Regulation) entered into force, meaning that 400 million Europeans will now be eligible to soon avail themselves of an EU Digital Identity Wallet which will shift Europeans from physical documents to digital IDs. This is a key step in the issuance of a European CBDC since digital euros will be stored in a digital wallet. Here is a video showing the "benefits" of Europe's Digital Identity Wallet:

Let's close with this recent news from Reuters, a potential fly in the ointment for a digital euro and, for that matter, all CBDCs:

A late February 2025 unprecedented outage in the ECB's Target 2 (T2) payment system caused widespread chaos for ten hours, blocking payment for more than 15,000 elderly and poor Greeks, pensions and salaries in Austria and several financial trades thanks to malfunctioning hardware. There was no backup system in place.

Here's more on the issue:

"This instance is a blow to the ECB’s credibility," said Markus Ferber of the European People's Party, the largest group in the current parliament.

"People will ask legitimate questions how the ECB will be able to run a digital euro when they cannot even keep their day-to-day operations running smoothly."

Despite this brief setback, the progress on the implementation of a digital euro continues to march forward and with end of the preparation phase of the payments ecosystem expected by October 31, 2025 and a potential development and rollout projected from November 2025 as shown here:

Unless the unforeseen should occur, it would appear that the implementation of the world's first advanced economy central bank digital currency is a sure thing.

No comments:

Post a Comment