While the

mainstream media focuses on the advantages and disadvantages of the current

debate on tax legislation, there is one group that has already benefitted

substantially from the endless back and forth; lobbyists. Here is a

brief summary of a report

by Public Citizen looking at

how Washington is still the land of the "Swamp", despite the

President's draining efforts.

To put this posting into

perspective, let's get a bit of background information on one of Washington's

favourite pastimes, lobbying. According to Open Secrets, this is what has

been spent on lobbying on an annual basis since 1998:

This is how many unique, registered

and active lobbyists there are on an annual basis since 1998, pounding

the pavement in Washington, doing their very best to get Congress to see things

their way:

And, last but not least, here is a listing of the top lobbying

clients for 2017 (to October 21) and how much they have spent:

With that background, let's look at

lobbying as it relates to the current tax debate. According to the study

by Public Citizen, a total of 6243 or 56.9 percent of lobbyists currently

actively working in Washington have disclosed that they are working on issues

involving taxation during the first three quarters of 2017 with more than 4200

working specifically on "tax reform". This means that there are

11.7 lobbyists working on some type of taxation issue for each of the 535

Members of Congress.

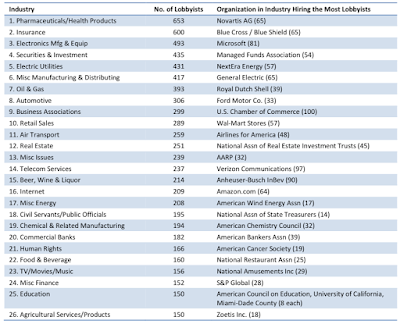

Let's look at a table showing which

industries have hired at least 150 lobbyists to work on tax issues in the first

three quarters of 2017, keeping in mind that some lobbyists work for more than

one client:

There are also twenty organizations

that have hired at least 50 lobbyists to work on tax issues during the first

three quarters of 2017. Here is list of the top ten hiring organizations

and a sample of the issues that concern them, noting that some organizations

also use in-house employees in addition to outside firms to lobby Washington:

1.) U.S. Chamber of Commerce: 100

lobbyists/2 outside firms - estate tax, corporate tax inversions, repatriation

of multinational business earnings, international competitiveness of corporate

tax, interest deductibility.

2.) Verizon Communications: 97

lobbyists/17 outside firms - corporate tax reform/rates/tax deductions, carried

interest, dividend taxation.

3.) Comcast: 90 lobbyists/23

outside firms - corporate tax rate, bonus depreciation, interest

deductibility.

4.) Anheuser-Busch InBev: 90

lobbyists/19 outside firms - tax reform, interest deductibility, bonus

depreciation

5.) Blue Cross/Blue Shield: 86

lobbyists/14 outside firms - health insurance tax, tax provisions of the

Affordable Care Act.

6.) Microsoft Corp.: 81

lobbyists/16 outside firms - comprehensive tax reform, international tax,

foreign tax credit, R&D tax credit.

7.) General Electric: 65

lobbyists/7 outside firms - corporate tax rate/reform, taxation of

international operations.

8.) Novartis: 65 lobbyists/9

outside firms - comprehensive tax reform, international corporate taxation,

interest deduction, anti-inversion tax.

9.) Amazon: 64 lobbyists/6 outside

firms - corporate tax reform, international tax issues.

10.) NCTA the Internet and

Television Association - 64 lobbyists/12 outside firms - reducing tax rates

across the board, tax reform issues, interest deductibility, estate tax repeal.

As you can see from this posting,

the lobbying sector is already one of the beneficiaries of the ongoing (and

seemingly endless) tax debate that paralyzes Washington on a regular basis.

While it seems to be a rule of thumb that changes to the tax regime

benefit the wealthy among us, we can clearly see that the lobbyists and

lobbying firms in America benefit substantially from Washington's paralysis

when it comes to changing the tax code.

At the very least, the "Swamp" is alive and

doing well from the perspective of the lobbying industry.

No comments:

Post a Comment