The powers that (ought not) to be are doing their best to force Western consumers into adopting new lifestyles to meet their greenhouse gas emissions targets. Much of the burden of reducing carbon emissions will fall on the back of reducing the purchases of internal combustion engine (ICE) cars with many governments offering incentives to induce consumers into purchasing over-priced and under-tested electric vehicles (EVs) by insisting that these vehicles are zero emitters. According to Efficient Manufacturing, there are an estimated 2 billion internal combustion engines in use around the world, making it very difficult to achieve the goal of zero ICE vehicle sales, particularly when EV prices are significantly higher than equivalent ICE prices. As you will see in this posting, one bank has just announced how it will force its customers to adopt EV technology and you can assure yourself that this is just the first bank to take this drastic action.

Bank Australia is Australia's fifth largest customer-owned mutual bank when measured in terms of assets. It is a relatively small bank when compared to its peers, however, it offers a wide range of services to its customers/shareholders:

Business loans

Home loans

Transaction accounts

Credit cards

Saving accounts

Term deposits

Personal loans including lifestyle and car loans

Insurance including home and contents, landlord, renter's, personal risk, business, travel and health insurance

Given the push towards meeting Environment, Social and Governance or ESG targets as mandated by the United Nations, the bank has taken significant steps to reducing its own greenhouse gas footprint as shown here:

...here:

...and here

Let's look at a recent announcement from Bank Australia:

Here are some quotes with my bolds:

"Encouraging customers to think about their next vehicle purchase is an important part of Bank Australia’s climate action strategy and it aims to support them to make sustainable choices. Around 43% of Australia’s transport emissions are from passenger vehicles. Electric vehicles are a ready-to-deploy technology so they can be one of the fastest contributors to Australia meeting its climate goals.

In announcing this commitment at the National Electric Vehicle Summit in Canberra, Bank Australia Chief Impact Officer Sasha Courville said that encouraging the shift to electric vehicles will be an important step in decarbonising the Australian economy.

“By ceasing car loans for new fossil fuel vehicles, we are sending a signal to the Australian market about the rapid acceleration in the transition from internal combustion to electric vehicles we expect to see in the next few years.”

“We’ve chosen 2025 because the change to electric vehicles needs to happen quickly, and we believe it can with the right supporting policies in place to bring a greater range of more affordable electric vehicles to Australia."

Since 2018, the bank has offered discounted interest rates on lending for low emission vehicles since 2018. Since EVs are not widely available largely due to supply chain stresses related to the COVID-19 pandemic, the bank will "continue to support customers who can't yet access an electric vehicle as quoted here:

"While we will cease car loans for new fossil fuel cars from 2025, we are deeply aware that we need to support people not yet able to afford an electric vehicle while the market grows. We’ll continue to offer loans for second hand fossil fuel vehicles until there is a viable and thriving market for electric vehicles."

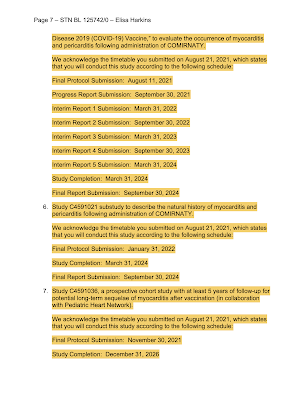

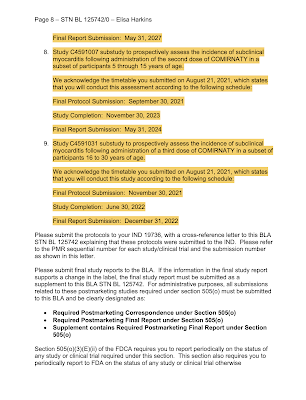

The press release closes by noting the importance of electric vehicles for their positive impact on the climate. Apparently, the bank's management hasn't considered the fact that the electricity needed to recharge EV batteries doesn't come from the burning of unicorn farts and that the mining of lithium and cobalt have significant negative environmental and social impacts as noted here:

Don't count on hearing about either of these issues from your local, first-order thinking politician.

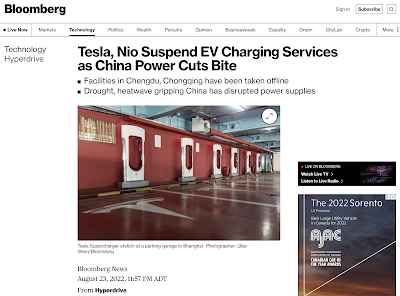

Given that the infrastructure to needed to support the charging of EVs is completely inadequate, an issue recently experienced in China:

...a situation that will become significantly worse as governments force the switching from fossil fuel- and uranium-based electricity generation to solar and wind power which are, at best, inconsistent, the move by Bank Australia to force its customers into adopting electric vehicles is ill-advised. That said, those of us who live in other nations should consider the fact that, under ESG guidelines, banks and other financial firms in Western nations are likely to adopt a similar philosophy to remain on the good side of the "ESG police".