A report out

of Canada's Scotiabank on the impact of Hurricane Sandy on the U.S. economy

raises some interesting points. Let's take a look at a few of the key

issues and a bit of background information.

August

2011's Hurricane Irene is estimated by the National Hurricane Center to have

caused about $15.8 billion in damages including $7.2 billion worth of inland

flooding and $4.3 billion worth of other damage plus an additional $4.3 billion

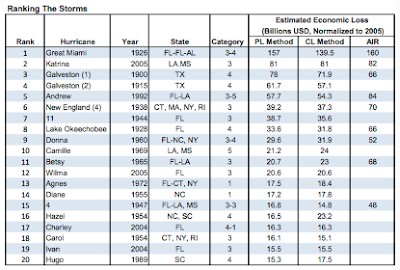

in uninsured damage. This storm ranks in the top-20 of all-time most

damaging storms to hit the United States Damage from August 2005's Hurricane Katrina is estimated to have reached in excess of $80 billion, putting it in the number

two in the top twenty all time hurricane damage list as shown here:

Let's look

at a chart that shows the impact on GDP of major disrupting events including Katrina in 2005, major snowstorms in 2010, Japan's earthquake in early 2011 and Irene in late 2011 (all events marked with a dark vertical line):

Keeping in

mind that the storm surges associated with Hurricane Sandy were higher and impacted

a much larger portion of the United States than Hurricane Irene, Scotia

Economics suggests that a 0.25 percentage point hit to GDP growth in the fourth

quarter of 2012 is possible, resulting in a downward revision of Q4

growth to 1.5 percent.

Damage of

the ports of New York and New Jersey resulting from Sandy will have some impact

on international trade. These ports import about four times as

many goods as they export; as a consequence, disruptions at the ports could

artificially improve the trade deficit figures (i.e. by lowering the trade

deficit) for the months of October and November 2012. Even though both

imports and exports could be interrupted, this is a bigger deal to imports

since, as noted above, these ports import far more than they export.

On the jobless

claims side, the second week of November could show lower than expected new

jobless claims figures, largely because government offices were closed and the

infrastructure shutdown made it difficult for the newly jobless to make their

claims. Once this abnormal drop is past, it is expected that initial

jobless claims will spike upwards due to business shutdowns related to storm damage.

This is in contrast to the experience after Hurricane Katrina; there was

no initial drop in claims prior to the upward spike as shown on this graph:

Here is a

look at the drop in job growth after 2005's Hurricane Katrina:

Notice that

2011's Hurricane Irene had little impact on job growth but that the Japanese

earthquake of March 2011 had a significant negative impact on jobs. Job

growth is expected to decline after Hurricane Sandy but the degree of loss

depends on the length of the disruption.

The impact

on retail sales is difficult to assess. Prior to and immediately

after any disaster, consumers are stocking up on items (i.e. generators) and

the demand for building supplies increases strongly after the event, pushing

retail sales up. On the negative side, disruption to business lowers

retail demand; this could be more evident in the case of Sandy due to the

widespread damage to both public and retail infrastructure. As shown on

this graph, retail sales after Hurricane Katrina showed a marked drop that was

not seen after Irene:

The biggest

negative impact could be on the earnings of the insurance sector.

Here is a graph showing the drop in earnings per share after both

Hurricane Katrina and the major snowstorms of 2010:

Only time

will tell us how this massive storm will impact the American economy but, in

light of the problems facing Europe, it would appear that the two issues

working in tandem may result in a greater impact than would normally be

expected.

Thank you for sharing this post. I found it very informative and interesting. Hurricane Sandy put a huge dent on the entire east coast. It damaged many businesses and impacted how they operate. My company was able to sustain minimal damage because we had a great disaster recovery management plan in place.

ReplyDelete