The global aristocracy is insistent that all of the peasant class must renounce their internal combustion engine vehicles, substituting EVs as the most important factor in solving the global climate crisis. As you will see in this posting, while this narrative is compelling if you are a first-order thinker, in fact, it is completely unworkable for one key reason.

Let's start with some background. PJM Interconnection is a regional electrical transmission organization that coordinates the movement of wholesale electricity in all or parts of the states of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia. It acts as a neutral, independent electricity wholesaler that manages the high-voltage electrical grid in the aforementioned states to ensure grid reliability for more than 65 million people, which makes it America's largest power grid.

Here is a map showing PJM's transmission zones:

PJM is moving toward decarbonization as shown on this screen capture from its 2021 Annual Report:

Here is a map showing PJM's proposed renewable energy projects that are under study for potential interconnection to the existing grid:

PJM recently released a public report entitled "Energy Transition in PJM: Resource Retirements, Replacements and Risks":

Here is a quote from the Executive Summary:

"Driven by industry trends and their associated challenges, PJM developed the following strategic pillars to ensure an efficient and reliable energy transition: facilitating decarbonization policies reliably and cost-effectively; planning/operating the grid of the future; and fostering innovation....

In light of these trends and in support of these strategic objectives, PJM is continuing a multiphase effort to study the potential impacts of the energy transition. The first two phases of the study focused on energy and ancillary services and resource adequacy in 2035 and beyond. This third phase focuses on resource adequacy in the near term through 2030.1

Maintaining an adequate level of generation resources, with the right operational and physical characteristics, is essential for PJM’s ability to serve electrical demand through the energy transition."

In the study, PJM examines a range of business scenarios up to the year 2030 and how the retirement of certain of their existing generation will impact their ability to deliver reliable electricity to their customers.

PJM anticipates that they will retire assets based on state and federal policies (i.e. environmental policies) which will result in deteriorating unit economics as the cost of mitigation and compliance to environmental regulations "economically disadvantages" those generation assets to the point where they have to be retired. Here is a graphic showing the policies and regulations that could impact PJM's assets:

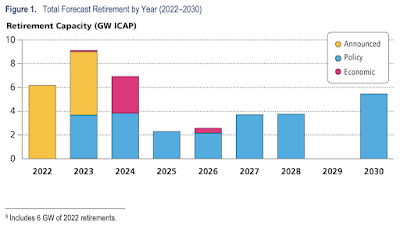

Here is a graphic showing the forecast electricity generation retirement capacity (Low New Entry and High New Entry scenarios) by year from 2022 to 2030:

Notice that most of the growth in retirement capacity is due to the implementation of environmental policies after 2024. In total, PJM projects that there will be a total retirements of 40 GW of projected generation by 2030 consisting of 12 GW of announced retirements, 25 GW of potential policy-driven retirements and 3 GW of potential economic retirements which, in total, represents 21 percent of PJM's current generation capacity. To maintain grid reliability, this shortfall must be covered using renewables.

Here is a graphic showing the low and high estimates for new installed capacity between 2022 and 2030:

PJM also notes that there will be an increase in electrification resulting in an increased demand for electricity (estimated at 1.4 percent per year with some zones demand growth reaching 7 percent per year) stemming from both state and federal policies and regulations. Previous research suggests that electricity demand growth in the future will be asymmetrical with demand growth in the winter more than double growth in the summer due to heating requirements. The combination of resource exit, entry and demand increases could cause significant problems as quoted here:

"The projected total capacity from generating resources would not meet projected peak loads, thus requiring the deployment of demand response. By the 2028/2029 Delivery Year and beyond, at Low New Entry scenario levels, projected reserve margins would be 8%, as projected demand response may be insufficient to cover peak demand expectations, unless new entry progresses at a levels exhibited in the High New Entry scenario. This will require the ability to maintain needed existing resources, as well as quickly incentivize and integrate new entry"

PJM states that there have only been about 10 GW of new service in the past three years and that there are significant risks to the entry of new generation thanks to supply chain disruptions and natural gas pipeline restrictions.

In conclusion, here is a graphic showing the electricity balance sheet issues:

Unless PJM is able to deliver on its high new entry capacity scenario, there could be a significant shortfall of electricity in its operating area by 2030 and even then, the company's reliance on intermittent renewable sources of electricity is concerning. The company states that they will need multiple megawatts of these resources to replace 1 megawatt of thermal generation.

Let's close with this quote from the report:

"PJM’s New Services Queue consists primarily of renewables (94%) and gas (6%). Despite the sizable nameplate capacity of renewables in the interconnection queue (290 GW), the historical rate of completion for renewable projects has been approximately 5%. The projections in this study indicate that the current pace of new entry would be insufficient to keep up with expected retirements and demand growth by 2030. The completion rate (from queue to steel in the ground) would have to increase significantly to maintain required reserve margins.

We can assure ourselves that PJM is not the only electricity wholesaler that is going to face the issue of generation shortfall. But, by all means, let's all go out a buy an electric vehicle. What could possibly go wrong?

No comments:

Post a Comment